Unleashing the Power of a Forex Trading Journal: The Secret Weapon for Your Trading Success!

- Jonny Smith

- June 28, 2023

- Forex Trading For Beginners

- Best_forex_broker, ECN_Forex, forex, forex_brokers

- 0 Comments

A Grand Hello, Forex Connoisseurs! 💹🎩

Heya, pip-collectors! 👋

Today, we’re putting the spotlight on a tool that’s the secret behind many successful traders: the Forex trading journal. Stick around as we delve into the how-to of creating your very own journal.

Trading Journal: Your Personal Treasure Map 🗺️💰

Consider your trading journal as your personal treasure map, guiding you through the dynamic landscape of Forex trading.

It’s a record of your trades, strategies, victories, mishaps, and all the juicy details in between. This isn’t just a diary—it’s your personal guide to consistency and growth in the whirlwind world of Forex.

Constructing Your Forex Trading Journal: The Nitty-Gritty Details 📐📝

Creating a Forex trading journal is a journey, not a race. Let’s break it down step-by-step:

1. Pick Your Platform: Notebook or Notepad? 📘🖥️

The initial step is deciding on the medium. You could opt for a classic notebook, an Excel sheet, or even a specialized trading journal software. The best tool is one that fits your style.

2. Record Your Trading Actions: Every Little Detail Counts 🔎📊

For each trade, make sure to note:

- Date and time: When did the trading action occur?

- Currency pair: Which currency pair were you dealing with?

- Entry and exit points: At what price points did you step in and step out?

- Outcome of the trade: Was it a victory or a defeat?

3. Jot Down Your Strategies: The Thought Process Behind the Trade 🧠⏱️

Delve into the strategy behind every trade. Why did you consider it a worthy trade?

Was it a unique pattern on the chart? A sudden economic news? Make sure to get it down.

4. Reflection Time: A Closer Look at Your Performance 🧐💭

Take a moment to ponder each trade. What worked? What could have been better? Honesty is key— it’s your stepping stone to trading excellence.

5. The Review Ritual: Hindsight for Foresight 🦉🔮

Make a habit of going through your journal entries regularly to recognize patterns.

Do you see certain strategies bringing home the profits consistently?

Or perhaps some trades that consistently incur losses? Use these insights to enhance your trading game.

John Doe’s Trading Adventure: A Case Study 🎭📚

Let’s spin a yarn about John Doe, a hypothetical Forex trader. John started maintaining a meticulous trading journal.

Over time, he identified that his trades yielded steady profits when he utilized a specific strategy on the EUR/USD pair, especially during the announcement of U.S. employment data.

Empowered with this newfound knowledge, John concentrated on mastering this strategy, resulting in his trading prowess soaring to new heights.

Don’t Forget About the Emotions: Your Mindset Matters! 😄😞

In addition to the nitty-gritty details of your trades, jot down your emotional state before, during, and after each trade. Were you feeling confident?

Anxious?

How did your emotions impact your decision-making process?

1. Record Your Goals and Progress: The Road to Improvement is Paved with Reflections 🏞️🎯

Always remember to note down your goals and objectives. Keep track of your progress. This will provide you with a bird’s eye view of your evolution as a trader and keep you motivated.

2. Get Visual: Charts and Graphs 📊📈

Who said trading journals had to be text-heavy? Incorporate visuals! Graph your profits, losses, or other significant data. This will make reviewing your trades more engaging and could highlight patterns you may have missed.

Trading Journal Best Practices: A Few More Tips 📚✨

- Consistency is key: Make sure you’re updating your journal consistently. It’s not just for the days you’re trading; it should be a part of your everyday routine.

- Make it yours: Customize your journal to suit your needs and style. The more it feels like ‘yours’, the more likely you are to use it.

- Be honest: Be brutally honest with yourself. The aim here is to learn and grow. If you sugarcoat your mistakes, you’ll only be cheating yourself.

A Tale of Two Traders: The Importance of a Trading Journal 📚🎭

Imagine two traders: Trader X and Trader Y. Trader X flies by the seat of his pants, making trades based on instinct and never keeps track of his strategies or performance.

Trader Y, on the other hand, maintains a detailed trading journal where she logs every trade, the strategy used, the outcome, and her reflections.

Fast forward a few months, and Trader Y has a clear advantage. She can learn from her past trades and tweak her strategies for better outcomes. Trader X, without a record of his past trades, remains stuck in a cycle of guesswork and unplanned actions.

The Pros and Cons: Everything Has a Flip Side 🎭🎲

Just like everything else, maintaining a Forex trading journal has its share of pros and cons. Let’s take a peek at what they are:

Pros 👍

- Accountability: A trading journal holds you accountable for your actions. It forces you to justify your trades and strategies.

- Improvement Over Time: By reviewing your journal, you can identify and rectify your mistakes, leading to continuous improvement.

- Emotional Control: Recording your emotions can help you understand how they impact your trading decisions. Over time, you can train yourself to control these emotions and make more rational choices.

Cons 👎

- Time-consuming: Maintaining a detailed journal can be time-consuming. But remember, the benefits it offers far outweigh the time you invest.

- Can Be Overwhelming: If you’re new to trading, you might find the process of logging every detail a bit overwhelming. Start small, with just a few key details, and gradually add more as you become more comfortable.

Implementing Trading Journal Insights: Applying What You Learn 🎓💡

Maintaining a trading journal is just half the story. The other half lies in effectively applying the insights you glean from it. Here’s how you can do that:

- Refine Your Strategy: Use your journal to identify which strategies work best and which ones need some tweaking.

- Improve Risk Management: Your journal can help you recognize trends in your wins and losses, enabling you to manage your risks better.

- Identify Strengths and Weaknesses: Your trading journal sheds light on your strengths and weaknesses as a trader. This awareness can significantly improve your performance.

The Evolution of Trading Journals: Embrace the Digital Shift 🌐🖥️

We’ve journeyed through the process of creating a traditional trading journal, but let’s not forget about the power of technology. Many traders are now opting for digital trading journals, thanks to the convenience, efficiency, and in-depth analysis they offer.

Digital Trading Journal Platforms: The Future is Here 🚀📱

There are several online platforms and apps available that offer robust tools to help you maintain a digital trading journal. Some of the most popular ones include:

1. Myfxbook: An automated analytical tool for your forex trading account that helps you analyze and improve your trading strategy.

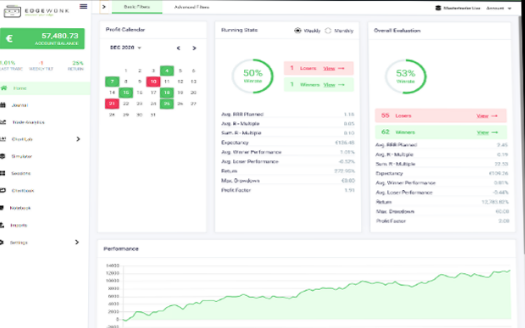

2. Edgewonk: A highly customizable trading journal that helps you find and analyze your edges in trading.

These platforms not only store your trading information but also provide comprehensive analysis, detailed reports, and even allow you to plan trades.

Transitioning from Paper to Pixels: A Smooth Switch 📝➡️💻

If you’re planning to switch from a traditional notebook to a digital trading journal, here are a few pointers:

- Start with a Basic Platform: Transition gradually. Start with a basic platform before moving to more complex software.

- Learn the Platform: Take the time to learn the features of your chosen platform. Use tutorials and guides to get started.

- Consistency: Just like with a paper journal, consistency is crucial in digital journaling. Make it a habit to record your trades regularly.

Conclusion: The Page Turns, The Journey Continues 📖⏳

Forex trading is a never-ending learning process, and a trading journal acts as a reliable companion on this exciting journey.

Whether you prefer ink on paper or pixels on a screen, the essence of a trading journal remains the same: it’s a tool for growth, self-reflection, and continuous improvement.

We hope this guide helps you create a trading journal that becomes a key player in your Forex trading success. And with that, we’ve reached the end of our tale. Until we meet again, remember: in trading and in life, the goal is to keep learning, keep growing, and keep moving forward. Happy journaling, and may the Forex odds be in your favor! 🎉🚀💰